How to Determin Which 540 Form to Use for Taxes

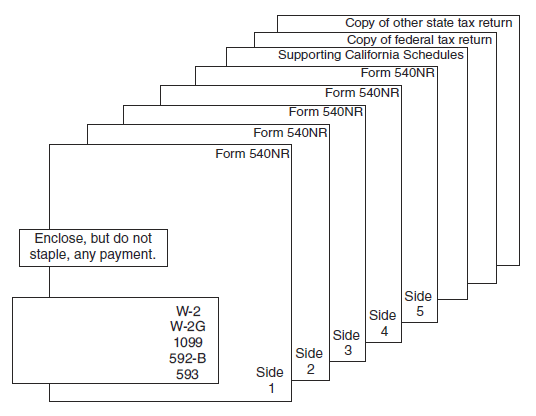

Be sure to line up dollar amounts. Instead make this payment separate from other payments and apply the.

12 California Form 540 Instructions 2016 Free To Edit Download Print Cocodoc

You must use the Use Tax Worksheet found in the instructions to calculate your use tax liability if any of the following apply.

. To calculate and report the use tax owed please. This calculator does not figure tax for Form 540 2EZ. The IRS will calculate the correct amount of the 2021 Recovery Rebate Credit make.

The seller does not collect California sales or use tax. Nonresident aliens use Form 1040-ES NR. Enter your social security number s SSN or individual taxpayer identification number s ITIN at the top of Form 540 Side 1.

Your taxable income is. You owe use tax on any item purchased for use in a trade or. Individual Income Tax Return Form 1040-X to claim it.

Attach form FTB 3800 to the childs Form 540. TaxAct helps you maximize your deductions with easy to use tax filing software. Austin Internal Revenue Service 3651 S Interregional Hwy 35 Austin TX 78741 855-203-7538.

For more information about Use Tax please visit. Form IT-540 2022 - WEB and instructions for 2021 should be used as a guide. If the amount due is zero you must check the applicable box to indicate that you either owe no use tax or you paid your use tax obligation directly to the California Department of Tax and Fee Administration.

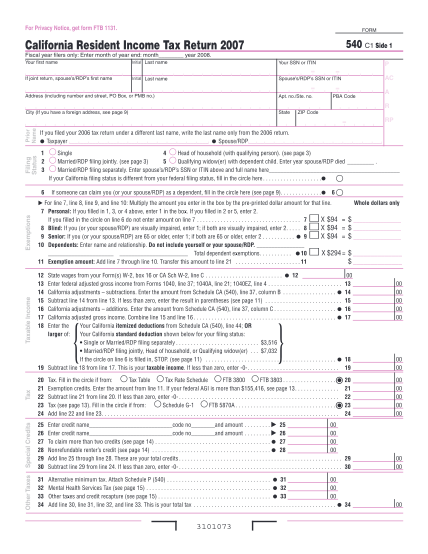

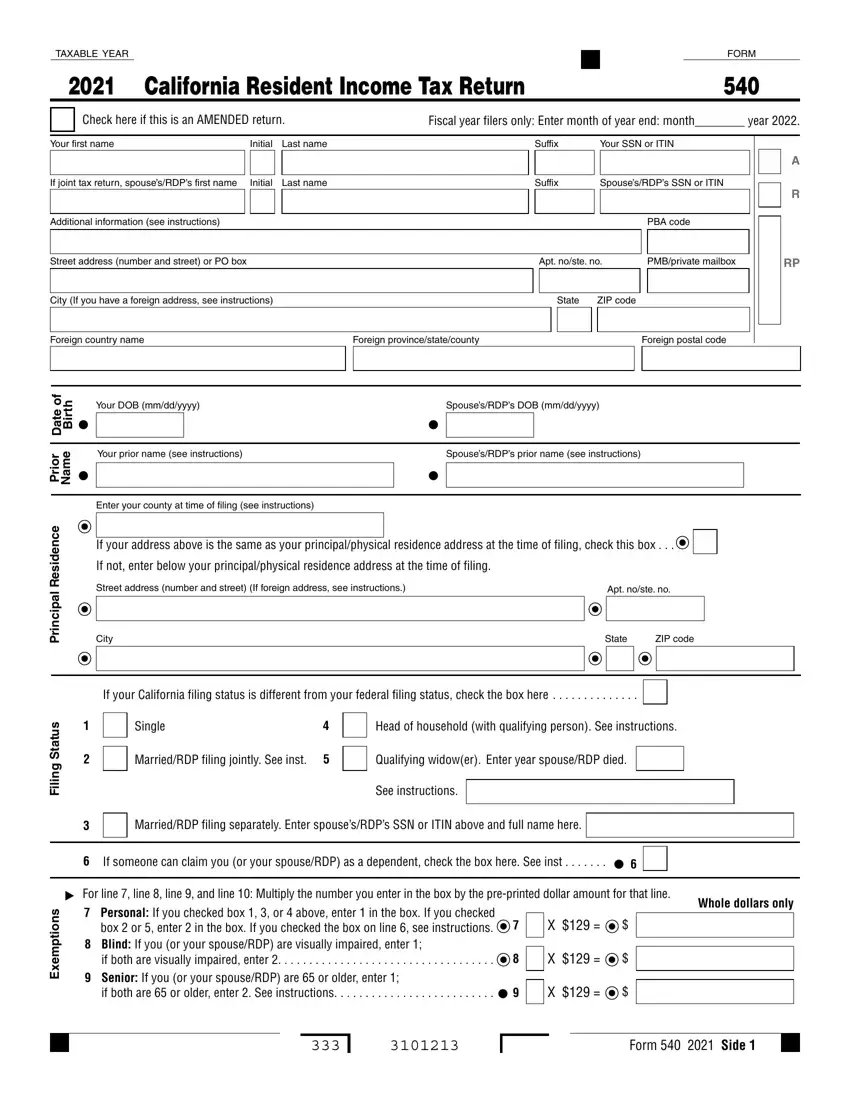

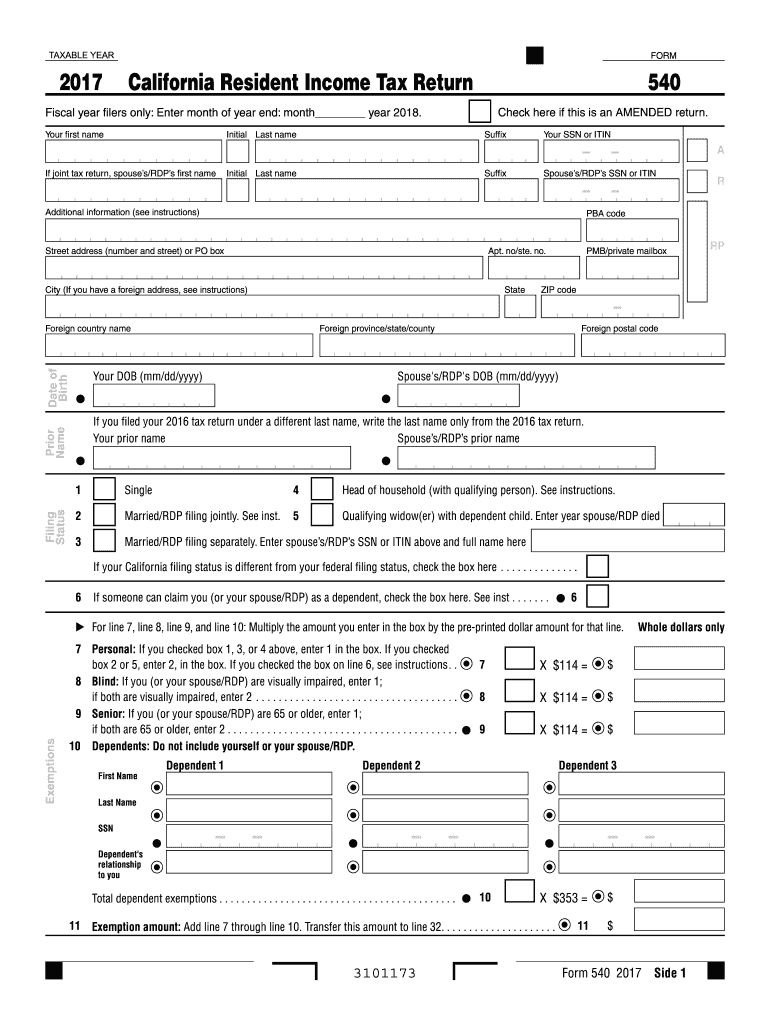

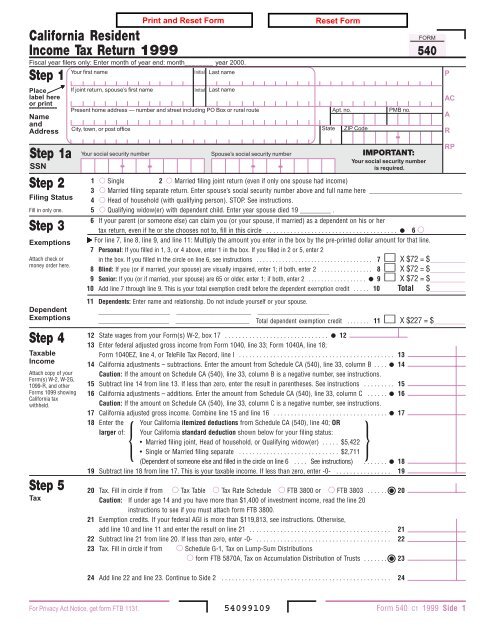

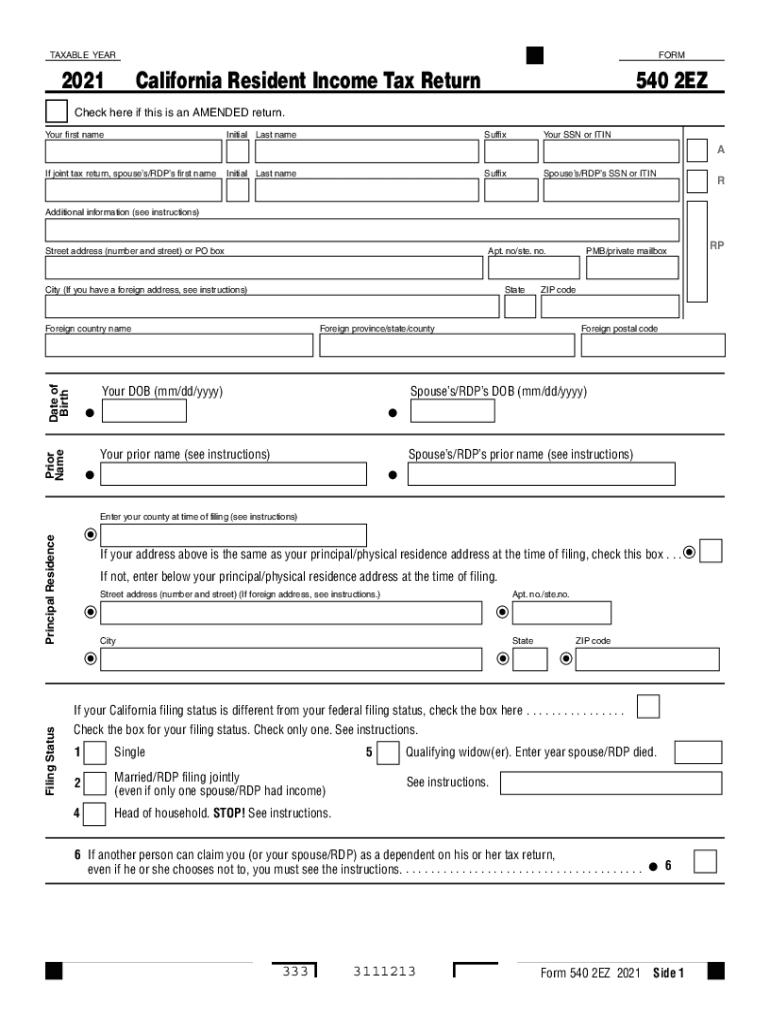

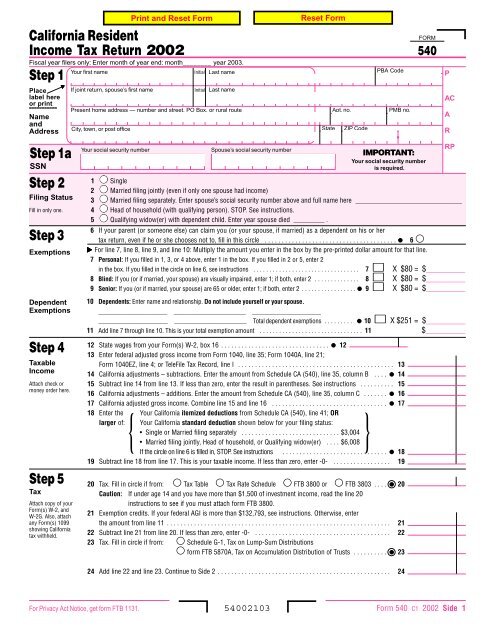

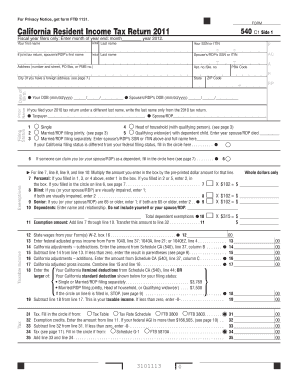

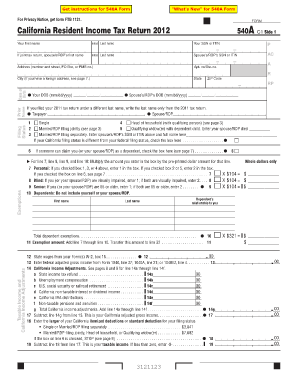

00 00 00 00 00 00 00 00 00 00 00 00 00. A Form 540 is also known as a California Resident Income Tax Return. If you first become liable to file a declaration on or before.

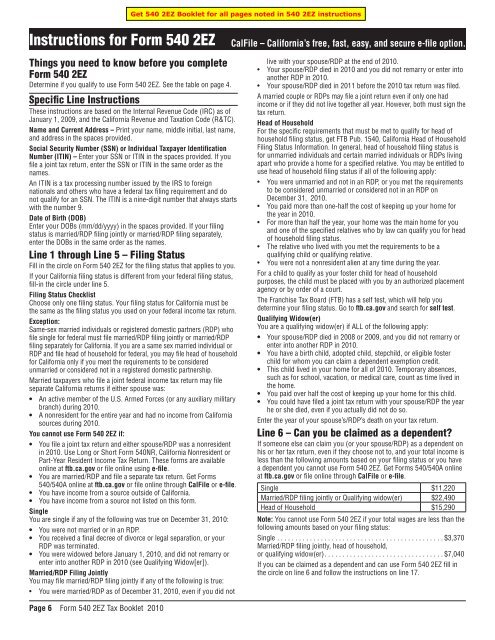

Enter the first 4 letters of your last name in these boxes. Form 540 EZ is a simple version of Form 540 that you can fill out if you meet certain criteria Your filing status is single marriedRDP filing jointly head of household or qualifying widower You have 0-3 dependents. Use tax is a sales tax on purchases made outside ones state of residence for taxable items that will be used stored or consumed in ones state of residence and on which no tax was collected in.

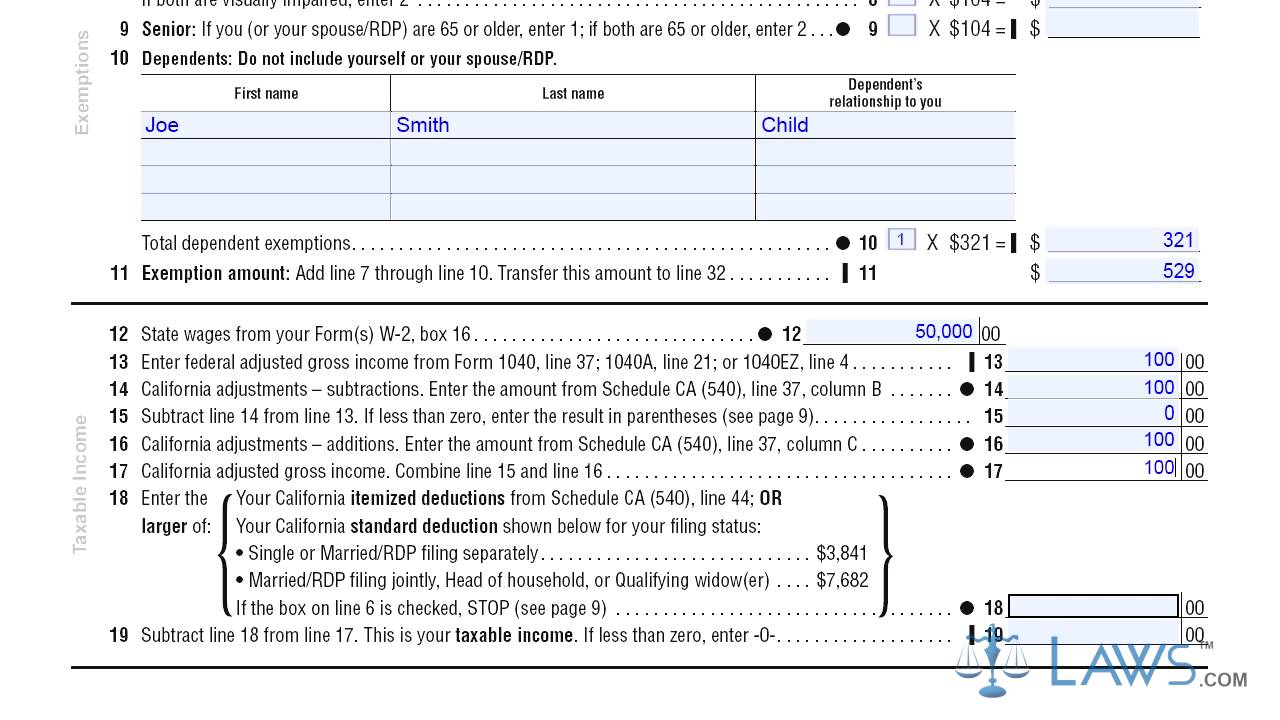

Transfer this amount to line 32. You are required to enter a number on this line. Do not include dollar signs commas decimal points or negative amount such as -5000.

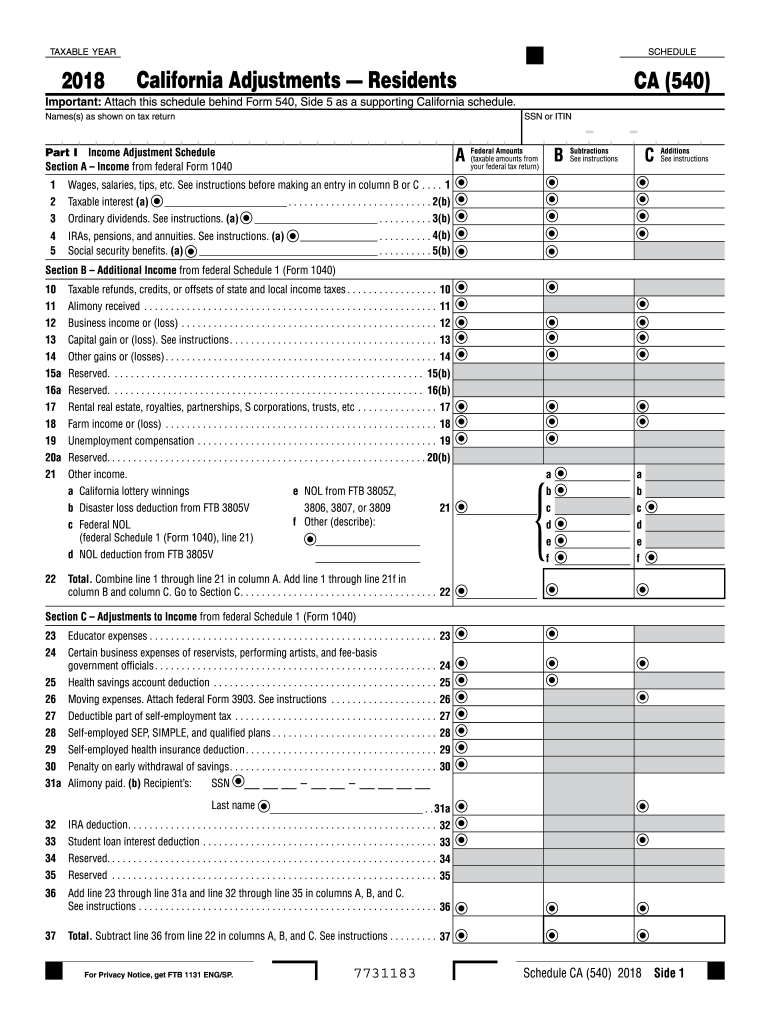

California adjustments subtractions. Attach form s FTB 3803 to your tax return. Start filing for free online now.

7 federal adjusted gross income enter the amount of your federal adjusted gross income from the npr worksheet federal column line 12. Generally use form FTB 3800 Tax Computation for Certain Children with Unearned Income to figure the tax on a separate Form 540 for your child who was 18 and under or a student under. Use tax does not apply if you paid sales tax.

Generally use form FTB 3800 Tax Computation for Certain Children with Unearned Income to figure the tax on a separate Form 540 for your child who was 18 and under or a student under age 24 on January 1 2021 and who had more than 2200 of investment income. The IRS will not calculate the 2021 Recovery Rebate Credit for you if you did not. You prefer to calculate the amount of use tax due based upon your actual purchases subject to use tax rather than based on an estimate.

Print numbers and CAPITAL LETTERS between the combed lines. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. Use black or blue ink on the tax return you send to the FTB.

California Use Tax Information. If you filed a Schedule H or Schedule SE with your Form 1040 or 1040-SR for 2020 and deferred some of the household employment andor self-employment tax payments you owe for 2020 dont use Form 1040-ES to make this payment. Personal information First name middle initial last name suffix SSN or ITIN Spouses name and SSN or ITIN Additional information PBA code Street address Date of birth Spouses date of birth Prior name Spouses prior name Filing status.

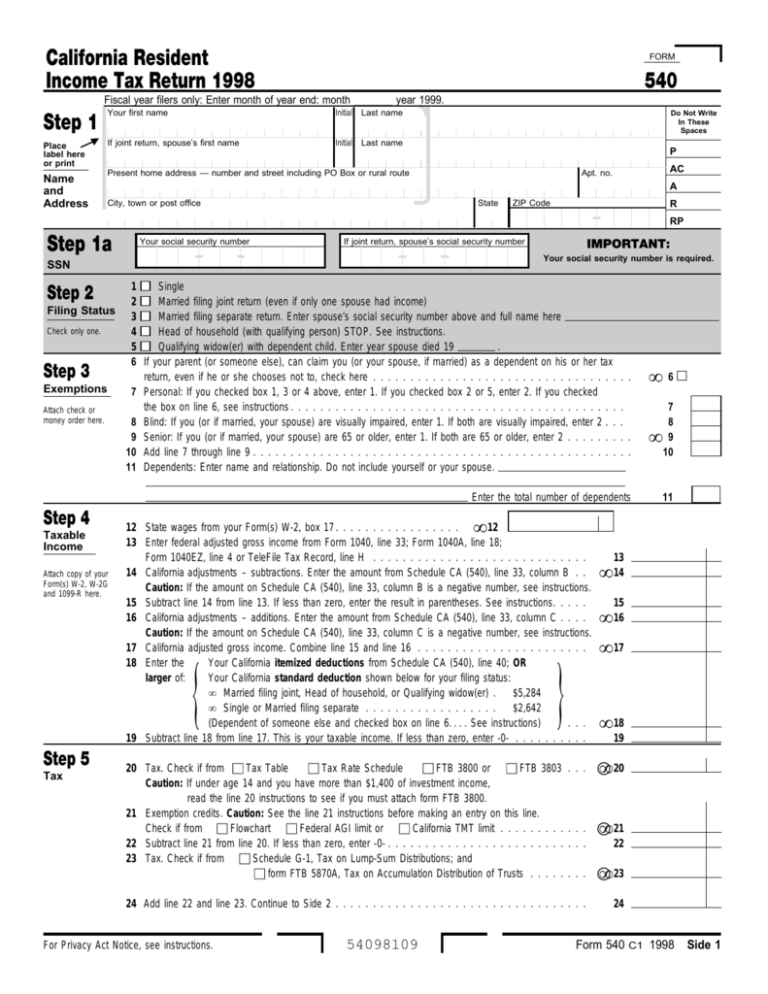

If you are a resident and earn a taxable income then you are required to file in California with Form 540. Items that are exempt from sales tax are also exempt from use tax. 8 louisiana adjusted gross income enter the amount of your louisiana adjusted gross income from the npr worksheet line 20.

Then enter on Line 10 and in Amount of Payment block on Form IT-540ES. Add line 7 through line 10. Ad Over 85 million taxes filed with TaxAct.

Form IT-540 and instructions for 2020 should be used as a guide. The Lookup Table below may be used to pay estimated use tax for personal items purchased for less than 1000 each. If you prepared a 2020 return on Form IT-540 or Form IT-540B and expect your income in 2021 to be the same as it was for 2020 you may compute your estimated tax using the information from your 2020 return.

For example checking withholding can. For employees withholding is the amount of federal income tax taken out of their paycheck. See the Form 540 Instructions.

You use give away store or consume the item in this state. Pay on Your State Income Tax Forms. To complete a Form 540 you need to provide the following information.

Form 540 is the state of California Income Tax Form. Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. Taken from California instructions from Form 540.

9 ratio of louisiana. The difference between the tax withheld or already paid to the state and the amount due is either the amount of tax you owe or the amount of refund you are owed. Fill out the worksheet above to calculate your estimated tax for 2021.

If you have not saved your receipts you may calculate and pay estimated use tax on your 2021 California Income Tax return based upon your income. If you bought tax-free items online in another state or in a foreign country you may owe use tax. Taxpayers can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit it to their employer.

State wages from your federal Forms W-2 box 16. You are required to enter a number on this line. This section came up under my State Tax Review.

Add the amount of tax if any from each form FTB 3803 line 9 to the amount of your tax from the tax table or tax rate schedules and enter the result on Form 540 line 31. On your California state income taxes using forms 540 or 540 2EZ simply put in the amount owed on the appropriate line for the entire year 1. Use lines 71-74 to disclose the amount of tax withheld to date.

Worksheet for Estimating Your 2022 Louisiana Individual Income Tax Keep for your records. Enter federal adjusted gross income from federal Form 1040 or 1040-SR line 11. Enter your tax due on line 111 and any refund due on line 115.

File a separate form FTB 3803 for each child whose income you elect to include on your Form 540.

Form 540 California Resident Income Tax Return Youtube

1998 Form 540 California Resident Income Tax Return

Ca 540 Form Fill Out Printable Pdf Forms Online

Form 540 Fill Online Printable Fillable Blank Pdffiller

Ca Ftb 540 2005 Fill Out Tax Template Online Us Legal Forms

Get And Sign Ca 540 Tax Form 2017 2022

Irs Form 540 California Resident Income Tax Return

Ca Ftb 540 2018 Fill Out Tax Template Online Us Legal Forms

Form 540 2ez Instructions California Franchise Tax Board

Form 540 1999 California Resident Income Tax Return

Ca Ftb 540 2ez 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

Irs Form 540 California Resident Income Tax Return

2002 Form 540 California Resident Income Tax Return 2002

Printable Ca Form 540 Resident Income Tax Return Pdf Formswift

540 Form California Resident Income Tax Return

Form 540 Instructions Fill Out And Sign Printable Pdf Template Signnow

California 540 Fill Out And Sign Printable Pdf Template Signnow

Ftb 5822 Ens Quick Resolution Worksheet Pdf Fill Out And Sign Printable Pdf Template Signnow

Comments

Post a Comment